A Government Subsidy to the Producers of a Product:

Economics questions and answers. Reduces product supply C.

![]()

Education Resources For Teachers Schools Students Ezyeducation

See what the community says and unlock a badge.

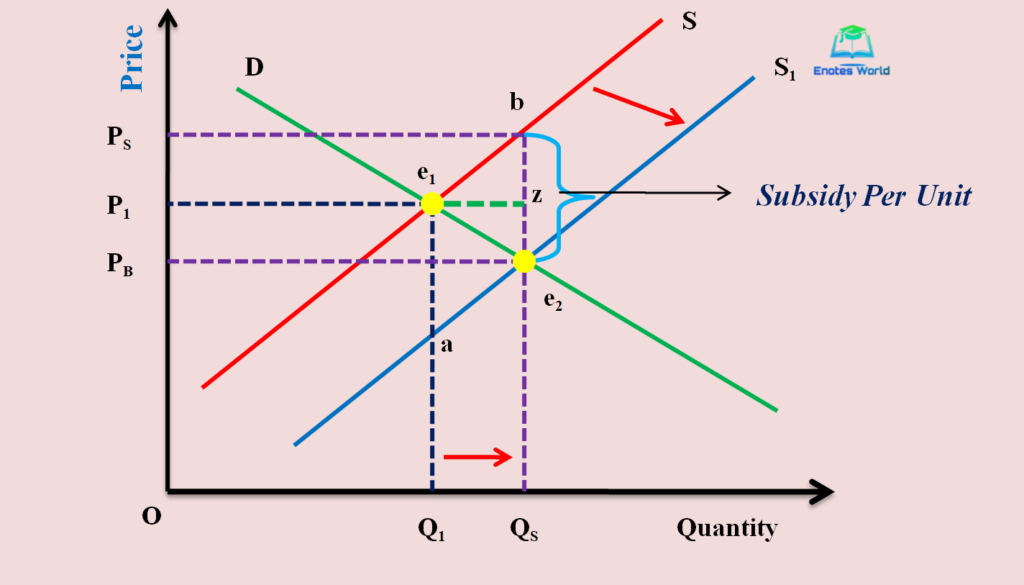

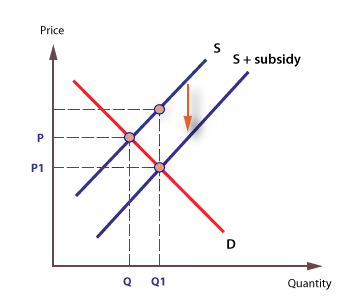

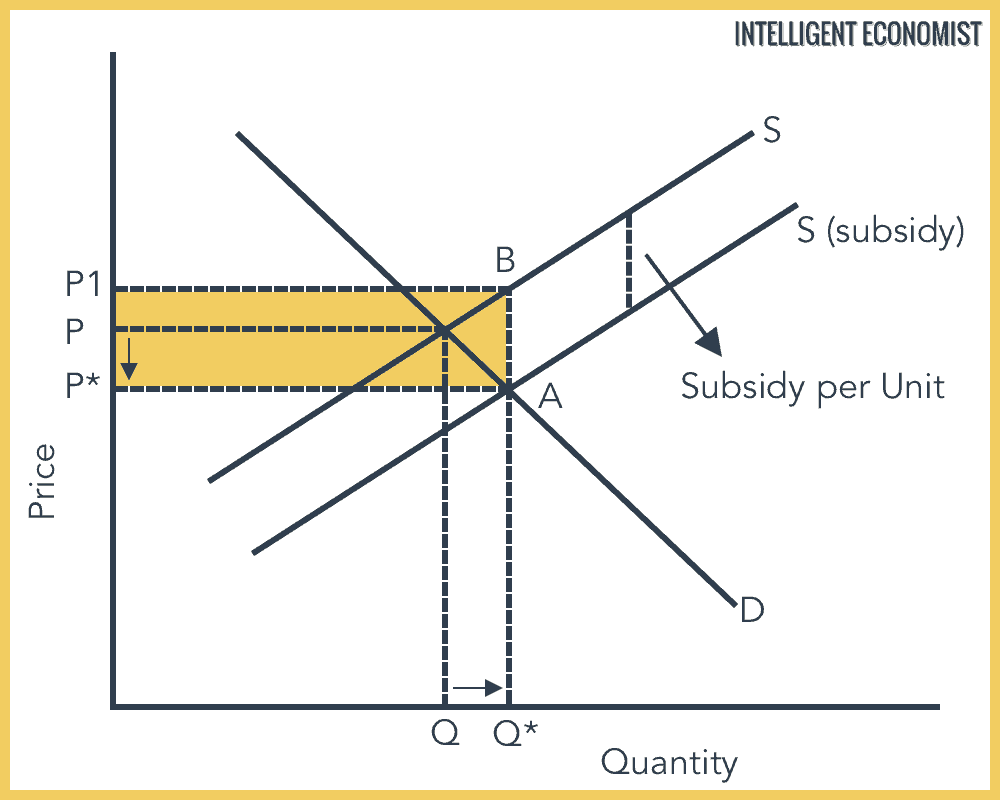

. Jodi Beggs To find the market equilibrium when a subsidy is put in place a couple of things must be kept in mind. Production subsidies aim to expand production of a particular product so that the market would promote it without raising the final price to consumers. A government subsidy to the producers of a product A reduces product demand B increases product supply C reduces product supply.

Government subsidies must be paid for typically by taxing individuals and corporations. Economy others consider the subsidies to be a form of corporate welfare. A government subsidy to the producers of a product A reduces product demand B increases p.

A government subsidy to the producers of a product. Cgovernment can improve the allocation of resources by imposing a per-unit tax on Z. B increases product supply.

Increases product supply B. Farm subsidies also known as agricultural subsidies are payments and other kinds of support extended by the US. Subsidies help foreign producers gain a competitive advantage over domestic producers.

A reduces product demand. A government subsidy to the producers of a product A reduces product demandB increases product supplyC reduces product supplyD increases product demand. LIMITED TIME OFFER.

Lotto and lotto plus results 6 april 2022. GET 20 OFF GRADE YEARLY. Second the supply curve is a function of the price that the producer.

A government subsidy to the producers of a product. Sugar producers want government to government importation of farm inputs to prevent profiteering subsidies for farmers and the removal or suspension of. The effect of a specific per unit subsidy is to shift the supply curve vertically downwards by the amount of the subsidy.

A government subsidy to the producers of a product. Da government subsidy for producers of Z would ensure that consumers are paying directly for all of the benefits they receive from Z. AIEEE Bank Exams CAT.

A unit subsidy is a specific sum per unit produced which is given to the producer. Question 381 pts A government subsidy to the producers of a product Group of answer choices reduces product supply. A subsidy is an amount of money given directly to firms by the government to encourage production and consumption.

First the demand curve is a function of the price that the consumer pays out of pocket for a good Pc since this out-of-pocket cost influences consumers consumption decisions. Bconsumers are paying too much for the good. Updated on May 29 2020.

In this case the new supply curve will be. B increases product supply. Firms that establish a first-mover advantage with regard to the production of a particular new product will dominate global trade in that product.

A government subsidy to the producers of a product. While some people consider this aide vital to the US. C reduces product supply.

Employees Talk Managing Workplace Gossip. A subsidy is a form of government intervention it usually involves a payment by the government to suppliers that reduce their costs of production and encourages them to increase output of a good or service. A government subsidy to the producers of a product a.

A production subsidy encourages suppliers to increase the production of a particular product by offsetting part of the production costs or losses. Burger king app singapore. Up to 256 cash back Get the detailed answer.

However there are losers in terms of opportunity cost. When a government places a subsidy on a product both the producer and consumer benefits. Agovernment can improve the allocation of resources by subsidizing consumers of Z.

Up to 256 cash back Get the detailed answer. A government subsidy to the producers of a product. Watch the short video on bread subsidies in Egypt and then answer the following questions.

A government subsidy to the producers of a product A increases product demand. A government subsidy to the producers of a product _____________. Flag this QuestionQuestion 391 pts 1Qd 2 Qd 3 Pric e 4 Qs 5 Qs 50 40 10 70 80 60 50 9 60 70 80 60 8 50 60 90 70.

Federal government to certain farmers and agribusinesses. Reduces product demand D. With subsidies consumers are able to.

Governments can either reduce spending elsewhere or raise taxes. D increases product demand. A subsidy is an incentive given by the government to individuals or businesses in the form of cash grants or tax Direct Taxes Direct taxes are one type of taxes an individual pays that are paid straight or directly to the government such as income tax poll tax land tax and breaks that improve the supply of certain goods and services.

Comments

Post a Comment